Knox County, TN real estate sales for the week of August 9th

- Image by volunteerjim via Flickr

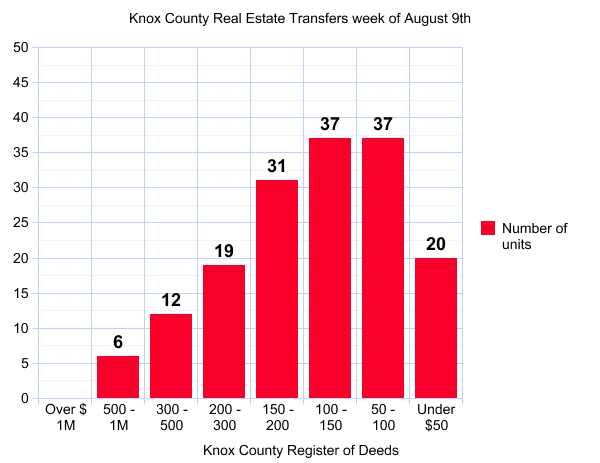

Today is Sunday, August 9th and the Knox County Register of Deeds reports 162 real estate transactions recorded for the week. Below is the breakdown by price range.

Past weeks sales as reported by the Knox County Register of Deeds office

So now that the year is over half gone and families are getting ready for the start of a new Knox County School year how are we doing with real estate sales so far in 2009. Here’s another graph of Knox County’s year to date property transfers.

Year to date Knox County sales

The average weekly sales year to date is 148. so it appears from the current data that the year has been fairly consistent especially when you factor in the seasonal adjustments for the historical peak selling months of June, July, and August.

I hear lots of stories from my fellow Realtors about “business getting better”, “I’m really busy”, and others but “getting better” and “really busy” doesn’t seem to be carrying over into closed sales.

I’m going to go out on a giant limb here and make some predictions about where I think the Knoxville area housing market is headed for the rest of 2009 and 2010.

- I think the modest price declines we’ve seen in our area have bottomed out. Luckily we did not have any drastic price/value declines even through the local volume is down over 50% in 2009 versus 2006. Before you start celebrating however I do not see any price rises in my crystal ball for 2009. I do see consumer confidence continuing to erode and unemployment continue to be a huge factor in housing sales. On the bright side, homebuyers with stable employment and good credit will find now an excellent time to buy.

- Numbers of houses for sale will start to decline. Not every seller has to sell today. Some want to sell to move up, downsize, or live in a different area. However if their house does not sell they still have the option to not sell and just stay where they are. I think a lot of sellers are getting tired of having their house for sale and will remove them from the active market. Although there will be fewer sellers those sellers will be motivated to sell and do whatever is necessary to make that happen.

- Banks are starting to find that simply foreclosing on a house and reselling it is far simpler and more of a sure thing for them than attempting loan modifications for existing homeowners behind on their payments. Look for more short sales and fewer ‘work out’ attempts.

- Interest rates could begin to rise soon. Investors have been very concerned about inflation for some time now and if the government adds a new supply of U.S. Treasuries to the market to offset the gigantic deficit watch out. Income tax revenues, both corporate and personal are down dramatically this year further hurting one of the governments primary sources of revenue.

- Rents will increase. Former homeowners that are foreclosed on will become renters and find higher prices because of the decreasing numbers of rentals available. New construction is almost at a standstill so no new rental units are being added to the market.

As always, www.KnoxvilleHomeCenter.com is an excellent place to see all of the greater Knoxville area Realtor listings for sale, no registration necessary.

Please feel free to comment here or contact me directly with any questions or comments.

Related articles by Zemanta

- Economists React: ‘Hopefully Bottom of Recession’ (blogs.wsj.com)

- Obama Officials: No Guarantee Taxes Won’t Go Up (huffingtonpost.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=c9153fa4-e4ce-456d-86fc-6197d841869d)

[...] This post was Twitted by RealtorJimLee [...]

Pingback on August 10, 2009 @ 8:47 am